Despite Sen. Joni Ernst’s claims that she illegally received a tax break for Washington homeowners in “error,” records showed that Ernst had to sign an affidavit to get the tax break.

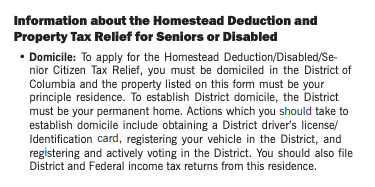

The District of Columbia’s requirements for homestead deductions. (D.C. Office of Tax and Revenue)

After the Des Moines Register reported Monday that Ernst, R-Iowa, illegally applied for multiple housing deductions for her homes in the capital and Iowa, Ernst attempted to mute the controversy by repaying the District of Columbia.

“Regrettably, this was an error and upon it being brought to her attention, she immediately paid back the D.C. Office of Tax and Revenue,” Ernst’s spokesman Brendan Conley told the Register.

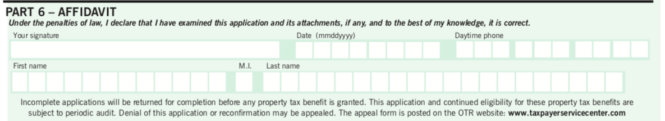

However, according to the district’s Homestead Deduction Application, homeowners must sign an affidavit, under penalty of perjury, that they are primary residents of Washington to receive the homestead tax credit.

In order to be considered a resident, the application states “the district must be your permanent home. Actions which you should take to establish domicile include obtaining a district driver’s license/identification card, registering your vehicle in the district, and registering and actively voting in the district.”

The District of Columbia’s homestead deduction application requires a signed affidavit. (D.C. Office of Tax and Revenue)

It is unclear whether Ernst viewed Iowa or Washington as her primary residence at the time, but the tax break is only available to D.C. residents and the application also specifies that a member of Congress is “not generally considered a District domiciliary.”

The penalty for homestead fraud in Washington is up to 180 days in jail and a $5,000 fine.

In total, Ernst received a nearly $1,900 tax break for her Washington home, while simultaneously receiving a $308.30 deduction for her property in Red Oak, Iowa. Ernst’s salary as a senator is $174,000 annually.

After the Des Moines register broke the story, Ernst returned the district tax credit in full.