Kentucky Gov. Matt Bevin, a multimillionaire who often preaches fiscal responsibility to his working- and middle-class constituents, was months late paying property taxes on his summer home in Maine the last two years, continuing a pattern of delinquent payments dating back nearly two decades.

Bevin, who is up for re-election in November, was late paying his taxes so often that the town of Greenwood, Maine, had to repeatedly issue liens against the property until he paid up, according to town records.

In August, Bevin, who grew up in New Hampshire not far from the Greenwood property, paid more than $800 in fines and interest on the 2017 tax bill that was due in April after a lien was placed against the property.

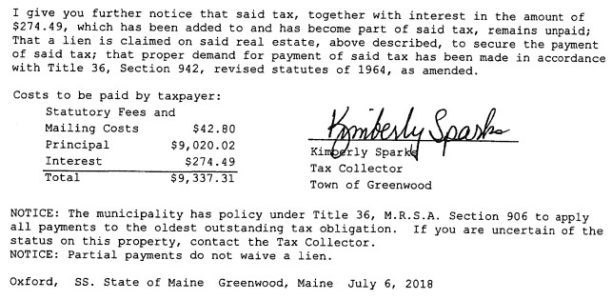

Then, three months later, he was four weeks late paying the bill again, incurring nearly $300 in penalties and late charges.

A letter sent to Bevin on July 6 informed him of a lean against his property in Maine. (Town of Greenwood)

Bevin has a history of paying his taxes late on various properties beginning in at least 2002. The 2017 and 2018 delinquencies had not been previously reported. Between 2002 and 2015, Bevin paid more than $1,100 in interest and fees for late payments on properties in Kentucky, Louisiana and Maine.

In 2017, the governor paid nearly $1,900 in penalties for being late paying taxes on his primary residence, in Cherokee Gardens, Ky., more than seven weeks late, WDRB reported at the time.

Bevin had an estimated net worth between $15 million and $60 million in 2014, making it difficult to explain his repeated late payments.

In one case in 2008, Bevin paid the taxes for his Maine house nearly a year late, blaming the lien filed against him on a “property mistake.”

Since taking office in 2015, he has pushed to increase work requirements for welfare recipients, led a successful effort to make Kentucky a right-to-work state, meaning unions can’t require workers join them or pay dues, and has called for significant cuts to teacher pensions.

Last year, he called teachers opposing his proposal to cut their pensions “selfish and short-sighted.”

In January, Bevin defended the state’s $500 fee for ex-convicts to have their records expunged by saying that if they can’t afford the charge, their priorities were out of order.

“When I hear a person who’s got a brand-new $500 tattoo telling me they don’t have $500 it’s hard for me to believe it,” he said.